Auf dieser Seite halten wir die Ergebnisse unserer Tradingportfolios nach. Die Ergebnisse/ Performance geben wir in % an, damit Sie sie unabhängig von ihrer Kontogröße vergleichen können. Die Portfolios handeln unterschiedliche Wertpapierarten. Zur Vereinfachung haben wir unabhängig davon jeweils eine Tradegebühr von 0.1 % angenommen.

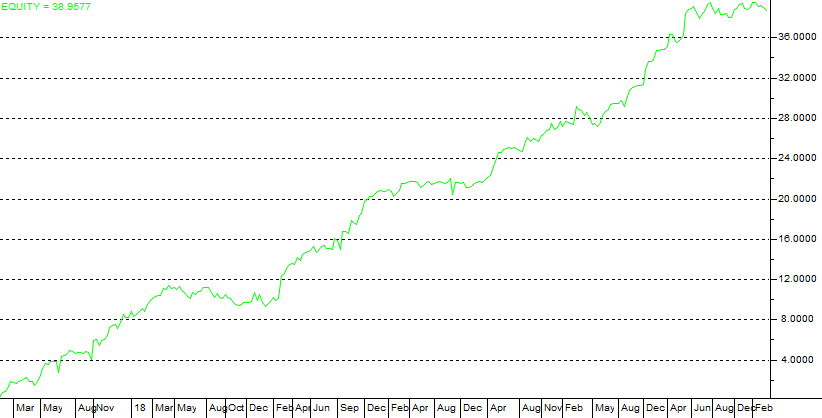

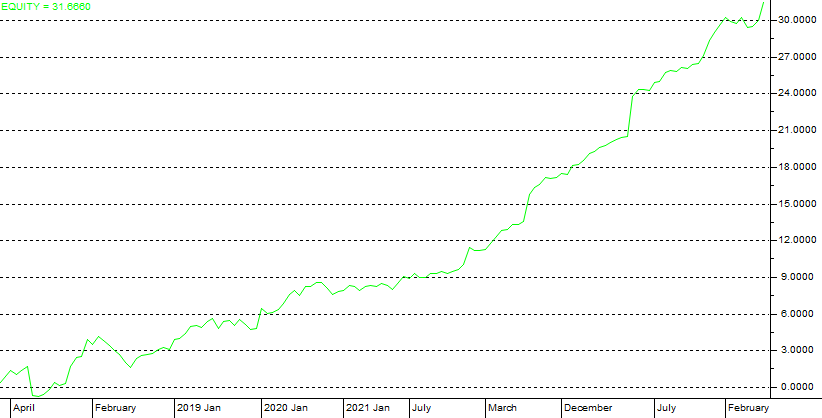

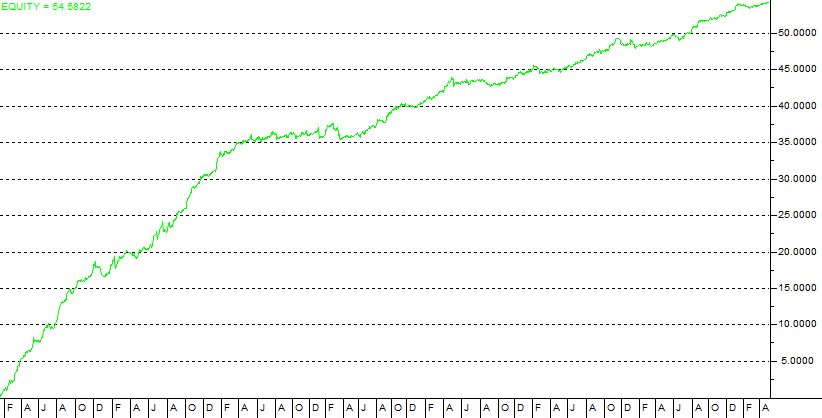

Performancegraphiken:

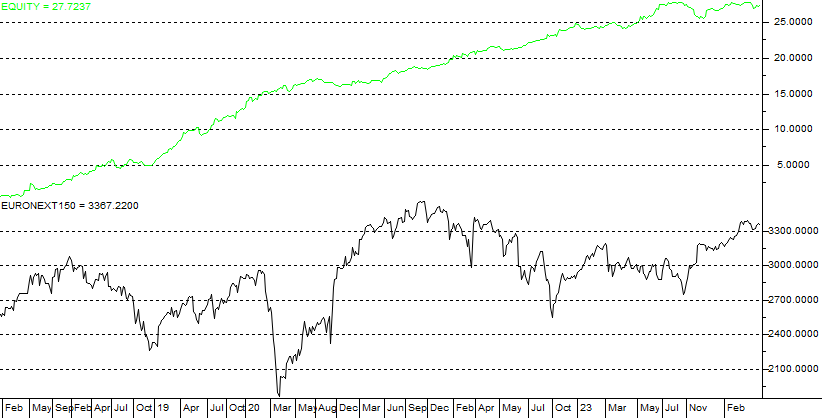

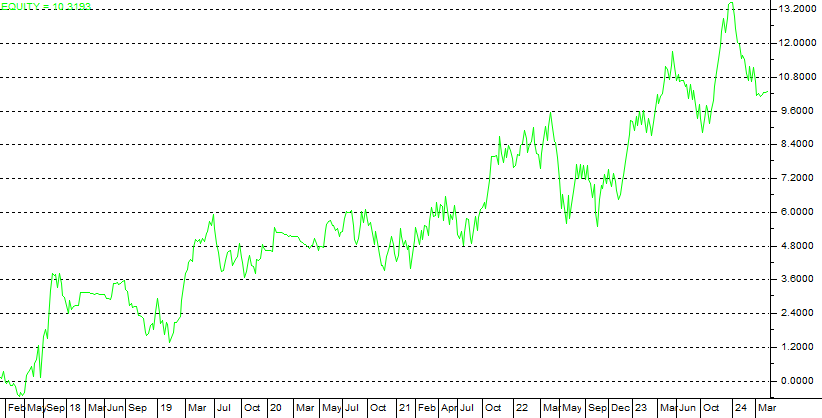

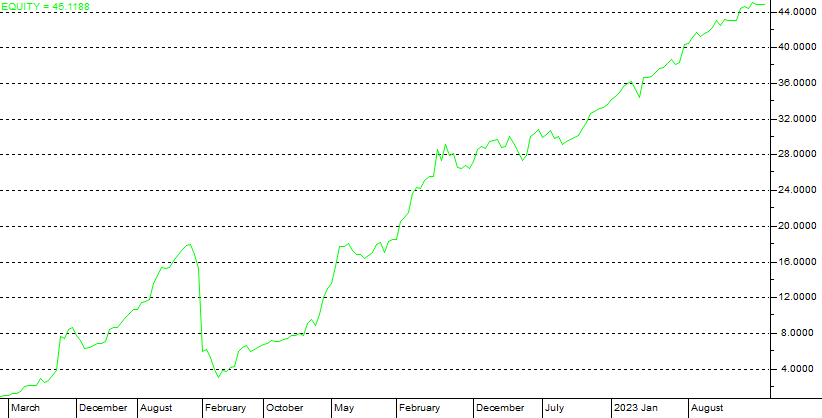

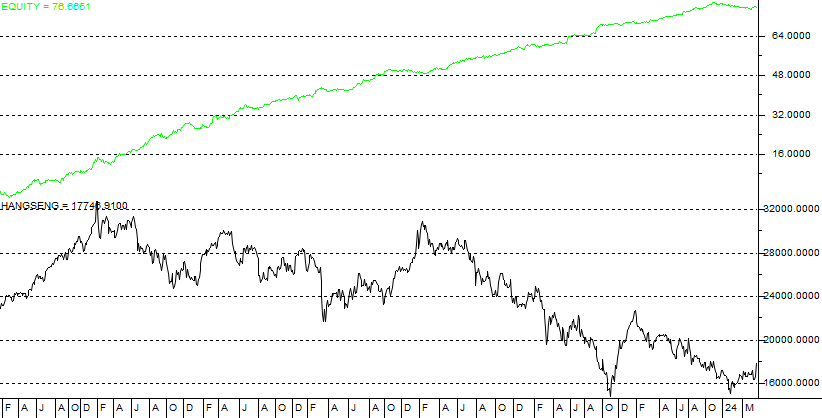

Grün = Performance, Schwarz = Vergleichsindex

| Parameter | |

|---|---|

| Total net profit | 38.8923 % |

| Total number of trades | 343 |

| Profitable | 63.56 % |

| Largest winning trade | 2.1587 % |

| Largest losing trade | -1.5657 % |

| Max drawdown | 1.9544 % |

| Profit factor | 2.3101 |

| Annual return on Account | 5.163 % |

| Number of Portfolio members | 62 |

| Maximum parallel open positions | 11 |

| Fee | .1 % |

Performance

4-Jahreschart Asian Titans

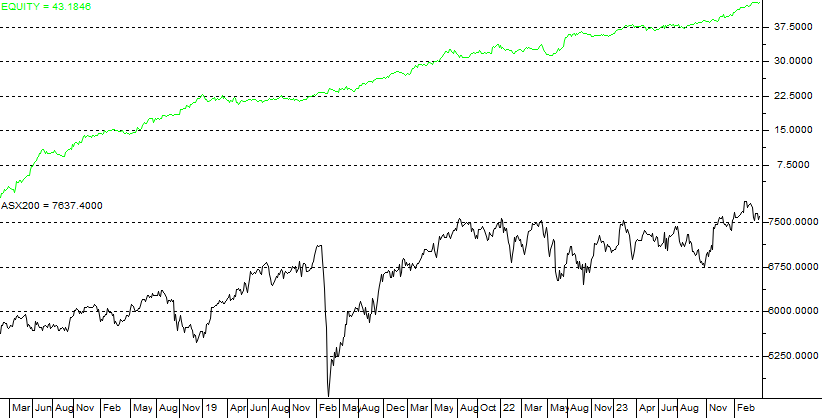

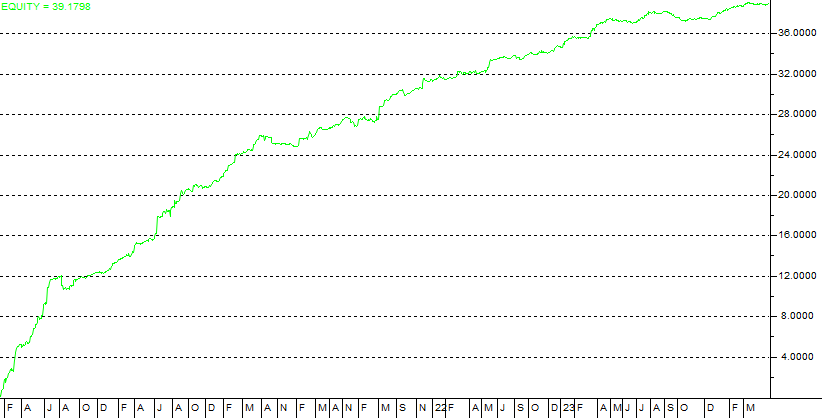

| Parameter | |

|---|---|

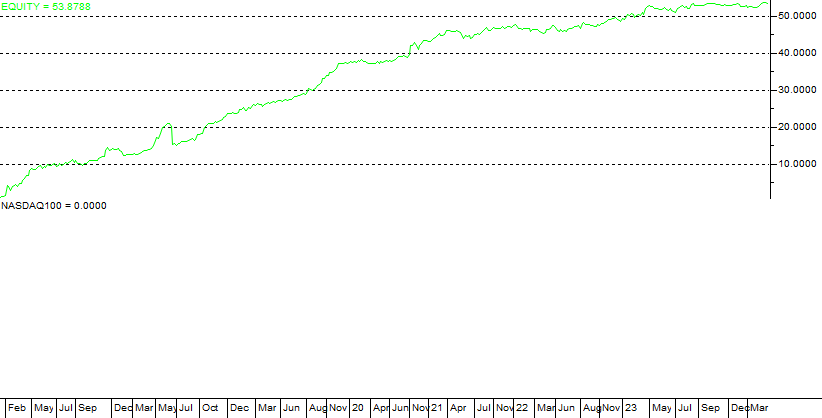

| Total net profit | 43.7355 % |

| Total number of trades | 1067 |

| Profitable | 60.36 % |

| Largest winning trade | 1.2643 % |

| Largest losing trade | -.5849 % |

| Max drawdown | 2.3465 % |

| Profit factor | 1.6523 |

| Annual return on Account | 5.8271 % |

| Number of Portfolio members | 868 |

| Maximum parallel open positions | 31 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index ASX200

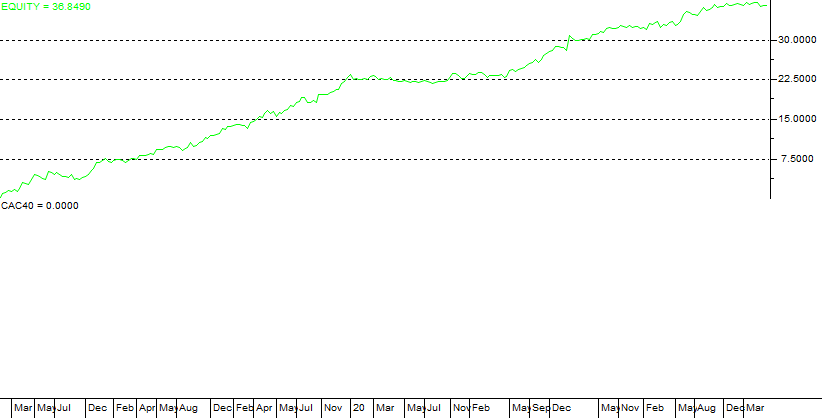

| Parameter | |

|---|---|

| Total net profit | 36.6751 % |

| Total number of trades | 320 |

| Profitable | 60 % |

| Largest winning trade | 2.8997 % |

| Largest losing trade | -1.176 % |

| Max drawdown | 1.8014 % |

| Profit factor | 2.2029 |

| Annual return on Account | 4.948 % |

| Number of Portfolio members | 41 |

| Maximum parallel open positions | 14 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index CAC40

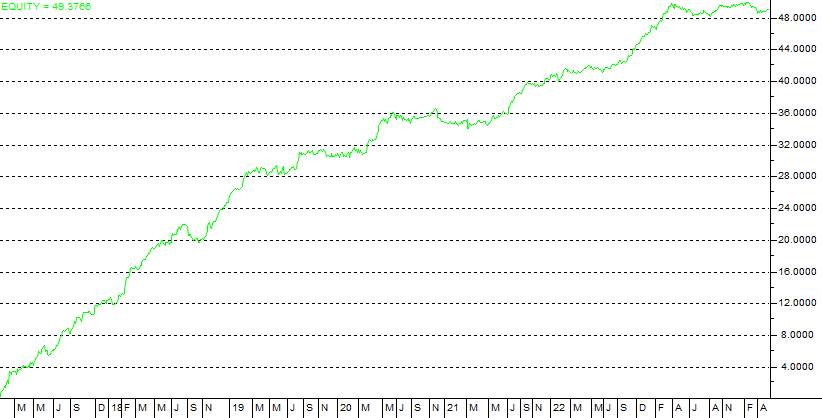

| Parameter | |

|---|---|

| Total net profit | 50.7938 % |

| Total number of trades | 1601 |

| Profitable | 59.53 % |

| Largest winning trade | .9051 % |

| Largest losing trade | -1.2074 % |

| Max drawdown | 3.1792 % |

| Profit factor | 1.5594 |

| Annual return on Account | 6.7453 % |

| Number of Portfolio members | 419 |

| Maximum parallel open positions | 46 |

| Fee | .1 % |

Performance

4-Jahreschart CDAX

| Parameter | |

|---|---|

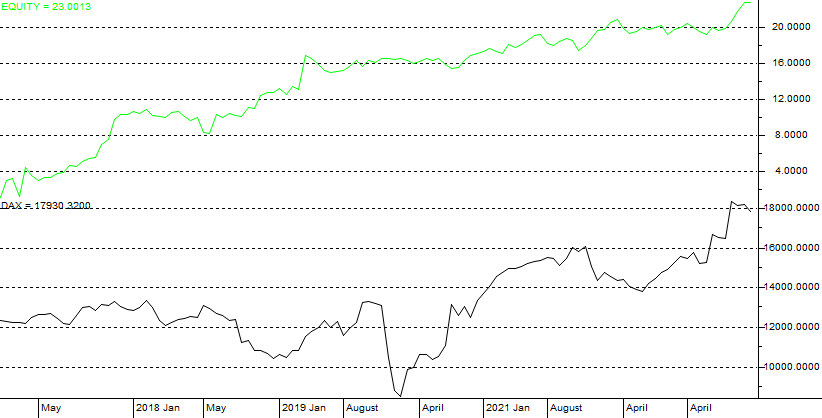

| Total net profit | 23.0443 % |

| Total number of trades | 143 |

| Profitable | 62.24 % |

| Largest winning trade | 3.2108 % |

| Largest losing trade | -2.0111 % |

| Max drawdown | 2.689 % |

| Profit factor | 1.9927 |

| Annual return on Account | 3.2262 % |

| Number of Portfolio members | 31 |

| Maximum parallel open positions | 9 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index DAX

| Parameter | |

|---|---|

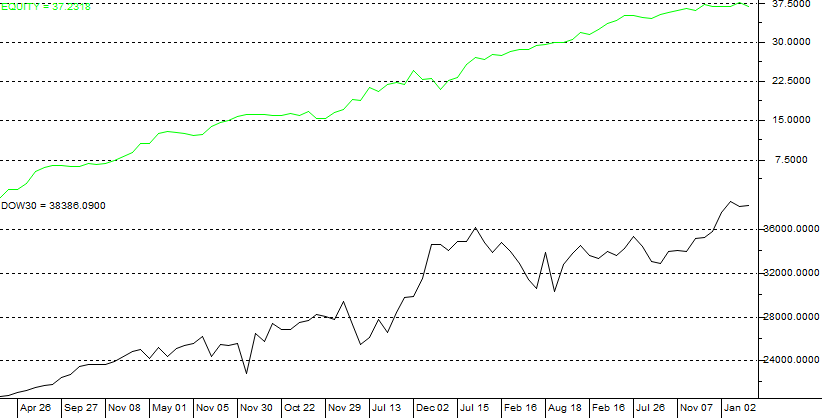

| Total net profit | 40.1776 % |

| Total number of trades | 116 |

| Profitable | 68.1 % |

| Largest winning trade | 2.1568 % |

| Largest losing trade | -1.3347 % |

| Max drawdown | 3.6944 % |

| Profit factor | 4.0353 |

| Annual return on Account | 5.3846 % |

| Number of Portfolio members | 30 |

| Maximum parallel open positions | 7 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index DJIA

| Parameter | |

|---|---|

| Total net profit | 19.9199 % |

| Total number of trades | 2316 |

| Profitable | 59.07 % |

| Largest winning trade | .321 % |

| Largest losing trade | -.2104 % |

| Max drawdown | 2.0934 % |

| Profit factor | 1.9008 |

| Annual return on Account | 2.6473 % |

| Number of Portfolio members | 1858 |

| Maximum parallel open positions | 86 |

| Fee | .1 % |

Performance

4-Jahreschart ETFs

| Parameter | |

|---|---|

| Total net profit | 37.0891 % |

| Total number of trades | 733 |

| Profitable | 61.94 % |

| Largest winning trade | 1.5035 % |

| Largest losing trade | -.7569 % |

| Max drawdown | 2.4502 % |

| Profit factor | 2.0984 |

| Annual return on Account | 4.947 % |

| Number of Portfolio members | 100 |

| Maximum parallel open positions | 27 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index Euronext 100

| Parameter | |

|---|---|

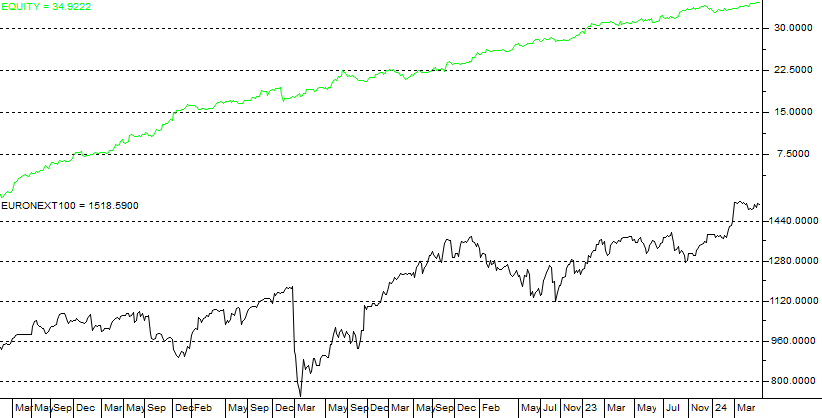

| Total net profit | 29.9963 % |

| Total number of trades | 741 |

| Profitable | 60.73 % |

| Largest winning trade | .9516 % |

| Largest losing trade | -.4899 % |

| Max drawdown | 2.4708 % |

| Profit factor | 1.7676 |

| Annual return on Account | 3.9878 % |

| Number of Portfolio members | 172 |

| Maximum parallel open positions | 37 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index Euronext 150

| Parameter | |

|---|---|

| Total net profit | 7.5177 % |

| Total number of trades | 328 |

| Profitable | 58.84 % |

| Largest winning trade | .9721 % |

| Largest losing trade | -.5547 % |

| Max drawdown | 2.2878 % |

| Profit factor | 1.529 |

| Annual return on Account | .9994 % |

| Number of Portfolio members | 47 |

| Maximum parallel open positions | 11 |

| Fee | .1 % |

Performance

4-Jahreschart Forex

| Parameter | |

|---|---|

| Total net profit | 12.8151 % |

| Total number of trades | 451 |

| Profitable | 61.86 % |

| Largest winning trade | .5079 % |

| Largest losing trade | -.5087 % |

| Max drawdown | 1.6384 % |

| Profit factor | 1.7769 |

| Annual return on Account | 2.7089 % |

| Number of Portfolio members | 99 |

| Maximum parallel open positions | 38 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index FTSE100

| Parameter | |

|---|---|

| Total net profit | 9.2039 % |

| Total number of trades | 524 |

| Profitable | 49.43 % |

| Largest winning trade | .6239 % |

| Largest losing trade | -1.1427 % |

| Max drawdown | 4.0843 % |

| Profit factor | 1.4137 |

| Annual return on Account | 1.2183 % |

| Number of Portfolio members | 22 |

| Maximum parallel open positions | 10 |

| Fee | .1 % |

Performance

4-Jahreschart Futures

| Parameter | |

|---|---|

| Total net profit | 48.9869 % |

| Total number of trades | 266 |

| Profitable | 69.92 % |

| Largest winning trade | 2.4037 % |

| Largest losing trade | -9.4278 % |

| Max drawdown | 15.0279 % |

| Profit factor | 1.5288 |

| Annual return on Account | 6.5677 % |

| Number of Portfolio members | 53 |

| Maximum parallel open positions | 10 |

| Fee | .1 % |

Performance

4-Jahreschart Global Titans

| Parameter | |

|---|---|

| Total net profit | 47.9626 % |

| Total number of trades | 255 |

| Profitable | 70.59 % |

| Largest winning trade | 2.4037 % |

| Largest losing trade | -9.4278 % |

| Max drawdown | 15.0279 % |

| Profit factor | 1.4865 |

| Annual return on Account | 6.4303 % |

| Number of Portfolio members | 53 |

| Maximum parallel open positions | 10 |

| Fee | .1 % |

Performance

4-Jahreschart Global Titans nur Longtrades

| Parameter | |

|---|---|

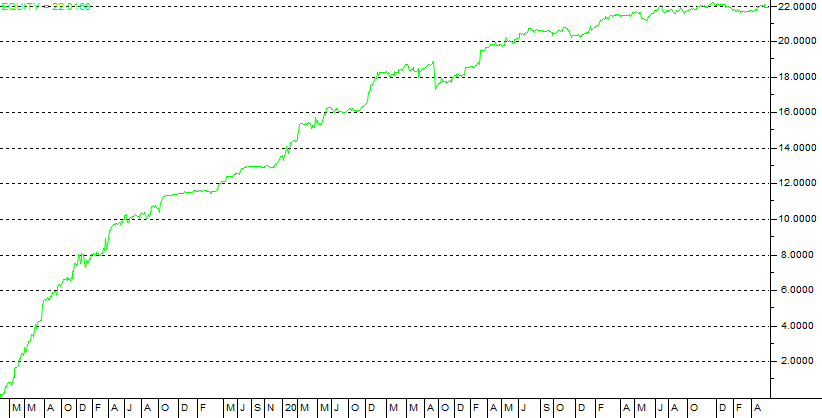

| Total net profit | 76.4823 % |

| Total number of trades | 1480 |

| Profitable | 59.8 % |

| Largest winning trade | 1.7954 % |

| Largest losing trade | -.6712 % |

| Max drawdown | 3.0023 % |

| Profit factor | 2.0012 |

| Annual return on Account | 10.1604 % |

| Number of Portfolio members | 880 |

| Maximum parallel open positions | 30 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index HangSeng

| Parameter | |

|---|---|

| Total net profit | 31.9476 % |

| Total number of trades | 175 |

| Profitable | 68.57 % |

| Largest winning trade | 3.2976 % |

| Largest losing trade | -1.1375 % |

| Max drawdown | 2.598 % |

| Profit factor | 3.2918 |

| Annual return on Account | 4.2927 % |

| Number of Portfolio members | 14 |

| Maximum parallel open positions | 8 |

| Fee | .1 % |

Performance

4-Jahreschart Indices

| Parameter | |

|---|---|

| Total net profit | 39.3553 % |

| Total number of trades | 3341 |

| Profitable | 62.95 % |

| Largest winning trade | .5624 % |

| Largest losing trade | -.4832 % |

| Max drawdown | 1.1941 % |

| Profit factor | 1.5205 |

| Annual return on Account | 5.2111 % |

| Number of Portfolio members | 4214 |

| Maximum parallel open positions | 165 |

| Fee | .1 % |

Performance

4-Jahreschart Indien

| Parameter | |

|---|---|

| Total net profit | 21.4741 % |

| Total number of trades | 390 |

| Profitable | 58.97 % |

| Largest winning trade | 1.5221 % |

| Largest losing trade | -1.1482 % |

| Max drawdown | 5.1865 % |

| Profit factor | 1.816 |

| Annual return on Account | 2.8601 % |

| Number of Portfolio members | 101 |

| Maximum parallel open positions | 15 |

| Fee | .1 % |

Performance

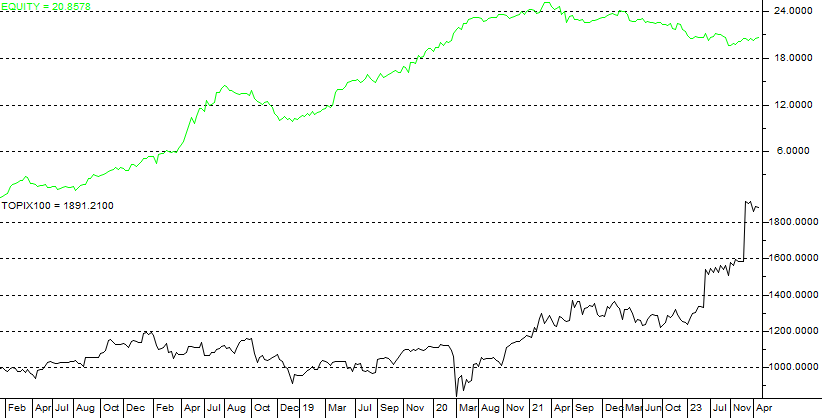

4-Jahreschart im Vergleich zum Index Topix100

| Parameter | |

|---|---|

| Total net profit | 28.4346 % |

| Total number of trades | 130 |

| Profitable | 60 % |

| Largest winning trade | 3.0423 % |

| Largest losing trade | -1.5273 % |

| Max drawdown | 6.1594 % |

| Profit factor | 1.1284 |

| Annual return on Account | 3.7706 % |

| Number of Portfolio members | 45 |

| Maximum parallel open positions | 6 |

| Fee | .1 % |

Performance

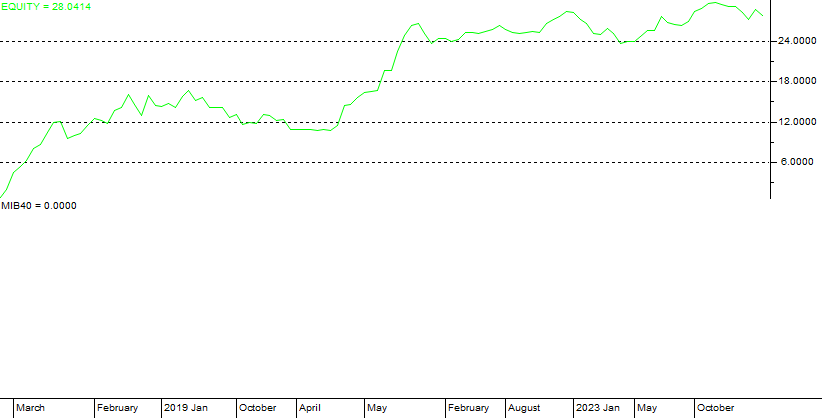

4-Jahreschart im Vergleich zum Index MIB40

| Parameter | |

|---|---|

| Total net profit | 60.0383 % |

| Total number of trades | 5872 |

| Profitable | 57.66 % |

| Largest winning trade | .9513 % |

| Largest losing trade | -.8729 % |

| Max drawdown | 2.0984 % |

| Profit factor | 1.3328 |

| Annual return on Account | 7.9411 % |

| Number of Portfolio members | 3136 |

| Maximum parallel open positions | 108 |

| Fee | .1 % |

Performance

4-Jahreschart NASDAQ

| Parameter | |

|---|---|

| Total net profit | 56.3644 % |

| Total number of trades | 585 |

| Profitable | 64.62 % |

| Largest winning trade | 2.693 % |

| Largest losing trade | -5.2377 % |

| Max drawdown | 6.3239 % |

| Profit factor | 1.4799 |

| Annual return on Account | 7.4769 % |

| Number of Portfolio members | 107 |

| Maximum parallel open positions | 18 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index NASDAQ 100

| Parameter | |

|---|---|

| Total net profit | 27.9749 % |

| Total number of trades | 677 |

| Profitable | 60.56 % |

| Largest winning trade | 1.3769 % |

| Largest losing trade | -.6624 % |

| Max drawdown | 4.5596 % |

| Profit factor | 2.2405 |

| Annual return on Account | 3.7396 % |

| Number of Portfolio members | 182 |

| Maximum parallel open positions | 33 |

| Fee | .1 % |

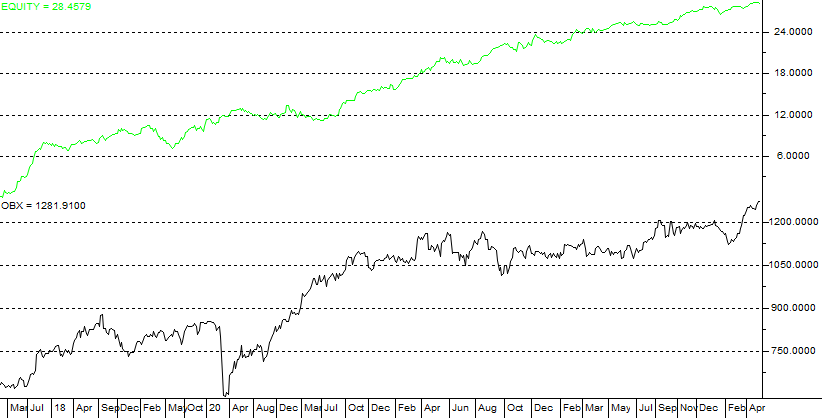

Performance

4-Jahreschart im Vergleich zum Index OBX

| Parameter | |

|---|---|

| Total net profit | 37.9144 % |

| Total number of trades | 6353 |

| Profitable | 60.16 % |

| Largest winning trade | .3358 % |

| Largest losing trade | -.3511 % |

| Max drawdown | 2.4954 % |

| Profit factor | 1.7371 |

| Annual return on Account | 5.0258 % |

| Number of Portfolio members | 2172 |

| Maximum parallel open positions | 186 |

| Fee | .1 % |

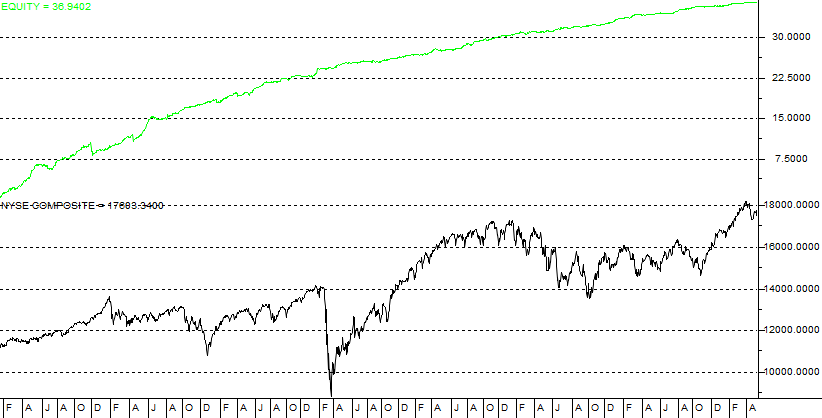

Performance

4-Jahreschart im Vergleich zum Index NYSE Comp

| Parameter | |

|---|---|

| Total net profit | 21.8715 % |

| Total number of trades | 1821 |

| Profitable | 56.01 % |

| Largest winning trade | .6836 % |

| Largest losing trade | -.9096 % |

| Max drawdown | 3.0799 % |

| Profit factor | 1.5291 |

| Annual return on Account | 2.9141 % |

| Number of Portfolio members | 502 |

| Maximum parallel open positions | 79 |

| Fee | .1 % |

Performance

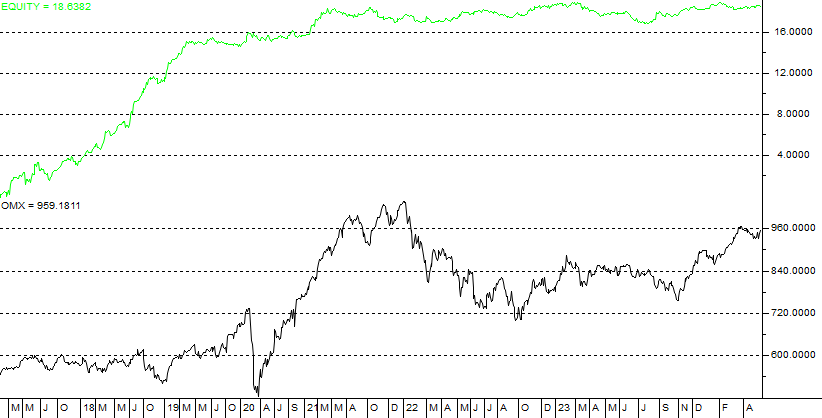

4-Jahreschart im Vergleich zum Index OMX

| Parameter | |

|---|---|

| Total net profit | 18.7904 % |

| Total number of trades | 175 |

| Profitable | 52.57 % |

| Largest winning trade | 4.5627 % |

| Largest losing trade | -1.7315 % |

| Max drawdown | 6.7342 % |

| Profit factor | 1.9489 |

| Annual return on Account | 2.5521 % |

| Number of Portfolio members | 137 |

| Maximum parallel open positions | 7 |

| Fee | .1 % |

Performance

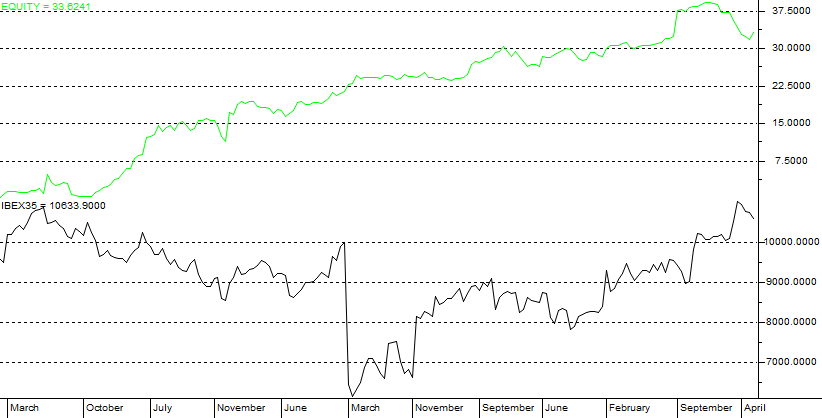

4-Jahreschart im Vergleich zum Index IBEX35

| Parameter | |

|---|---|

| Total net profit | 24.004 % |

| Total number of trades | 1025 |

| Profitable | 63.51 % |

| Largest winning trade | 1.2292 % |

| Largest losing trade | -1.4561 % |

| Max drawdown | 1.9539 % |

| Profit factor | 2.858 |

| Annual return on Account | 4.8977 % |

| Number of Portfolio members | 192 |

| Maximum parallel open positions | 65 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index SPI

| Parameter | |

|---|---|

| Total net profit | 46.4199 % |

| Total number of trades | 544 |

| Profitable | 60.29 % |

| Largest winning trade | 1.7467 % |

| Largest losing trade | -1.3173 % |

| Max drawdown | 7.3815 % |

| Profit factor | 1.6133 |

| Annual return on Account | 6.1645 % |

| Number of Portfolio members | 85 |

| Maximum parallel open positions | 17 |

| Fee | .1 % |

Performance

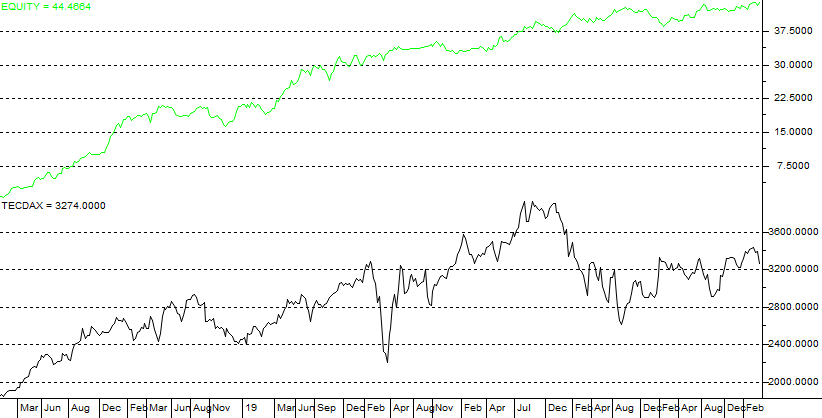

4-Jahreschart im Vergleich zum Index TecDax

| Parameter | |

|---|---|

| Total net profit | 93.8348 % |

| Total number of trades | 1649 |

| Profitable | 66.95 % |

| Largest winning trade | 2.3254 % |

| Largest losing trade | -3.0412 % |

| Max drawdown | 4.1323 % |

| Profit factor | 1.6021 |

| Annual return on Account | 12.4566 % |

| Number of Portfolio members | 69 |

| Maximum parallel open positions | 31 |

| Fee | .1 % |

Performance

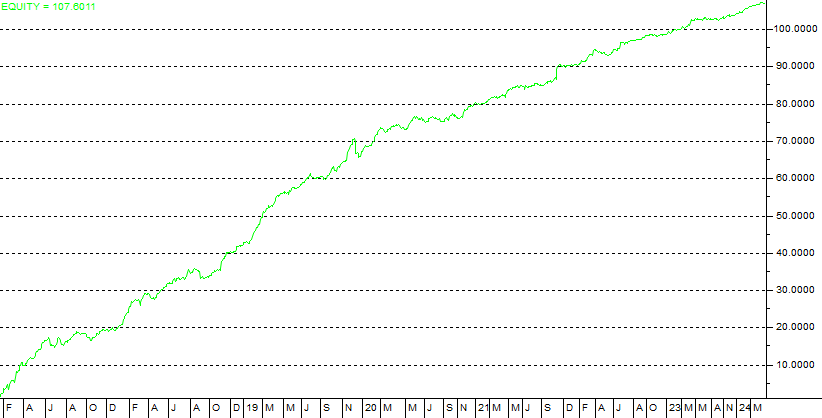

4-Jahreschart TopPerformer

| Parameter | |

|---|---|

| Total net profit | 37.6265 % |

| Total number of trades | 1310 |

| Profitable | 60.99 % |

| Largest winning trade | .8105 % |

| Largest losing trade | -1.0533 % |

| Max drawdown | 2.3912 % |

| Profit factor | 1.8088 |

| Annual return on Account | 7.9907 % |

| Number of Portfolio members | 547 |

| Maximum parallel open positions | 63 |

| Fee | .1 % |

Performance

4-Jahreschart im Vergleich zum Index DAX

Anmerkungen: Allen Ergebnissen liegt ein Hebel von 1 zugrunde. Es wurde jeweile eine Handelsgebühr von 0.1 % pro Trade zugrundegelegt. Alle Ergebnisse dienen der Information und sind keine Aufforderung zum Handel. Die Berechnung der Ergebnisse beruht auf den Kursdaten der jeweiligen Anlageinstrumente. Dadurch kann es im Einzelfall zu Abweichungen zu tatsächlichen Ergebnissen kommen, vor allem, wenn die gehandelten Aktien wenig Marktliquidität besitzen.

Überzeugt ? Dann können Sie unseren Service hier bestellen.